AML compliance

AML oversight, outsourcing, training

AML Services

Our team of certified anti-money laundering (AML) specialists offer a variety of services, including AML oversight and audit support, with a focus on virtual asset service providers (VASPs and CASPs). We also provide CO and MLRO outsourcing solutions and AML training.

AML oversight

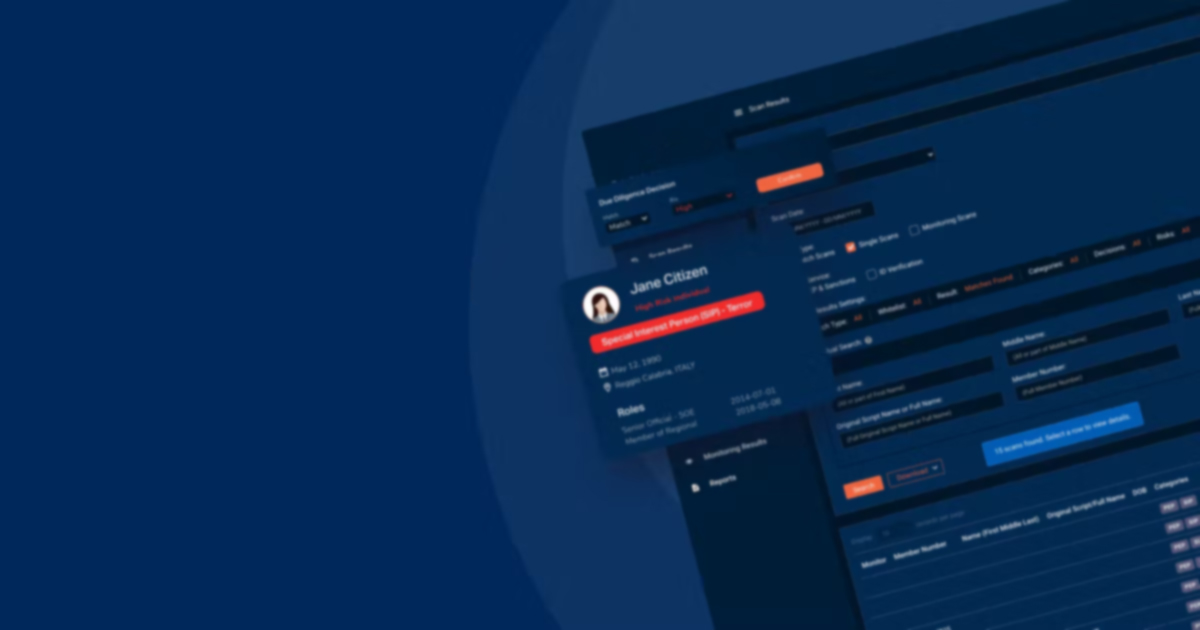

Our AML oversight team conducts evaluations of an organisation’s policies, procedures, and controls related to preventing, detecting, and reporting money laundering activities with the objective to comply with laws and regulations related to the prevention of money laundering.

The aim of the AML audit is to identify any weaknesses or shortcomings in the organisation’s AML compliance efforts and to provide appropriate recommendations for improvement.

In standard cases we can audit the AML policy (how the regulations apply), the AML procedures (how to onboard and monitor customers), and the AML business risk assessment (analysing the risks associated with customers, products, jurisdictions, delivery channels, and transactions, as well as explaining mitigating measures).

An AML audit may also be required by regulatory bodies or financial institutions as a condition for doing business with them.

Our team is comprised of certified AML specialists. Our extensive knowledge of AML compliance requirements in multiple sectors enables us to create a custom approach for each client’s unique business model.

Our AML oversight services include:

- Auditing and developing AML and international sanctions procedures and guidelines in accordance with relevant legislation, monitoring them, and updating them as needed in collaboration with the regulatory authority

- Conducting an AML audit of your company (rules of procedure, KYC systems, work processes etc)

- Offering consultations on AML matters, including assisting company employees in their daily work processes

- Clarifying and helping to implement KYC & KYT requirements

- Introducing, explaining, and supporting to implement due diligence and enhanced due diligence measures

Compliance outsourcing

We offer outsourcing packages for VASPs, regulated companies and financial institutions seeking solutions for employment of Compliance Officers (CO) and Money Laundering Reporting Officers (MLRO) to fulfil regulatory requirements.

Our MLROs have a strong track record of working with local authorities, regulators, and undergoing audits. They have regional expertise and have been vetted by local regulatory bodies.

We seek to match the requirements of your company with the experience and background required by the regulatory framework and the outsourced consultants work in partnership with the existing team (e.g. already existing back-office).

Our team is comprised of certified AML specialists. Our extensive knowledge of AML compliance requirements in multiple sectors enables us to create a custom approach for each client’s unique business model.

Some of the tasks of an outsourced CO or MLRO may include:

- Monitoring the business in accordance to the local laws and legal requirements

- Identifying compliance and financial crime risks and advising on appropriate systems and controls

- Documenting and implementing the compliance and financial crime policies and procedures

- Keeping the management up to date on changes in relevant regulations and their implications

- Investigating, preparing and reporting Suspicious Activity Reports (“SARs”)

- Assuming responsibility to communicate with supervisory authorities and regulators

AML training

AML training is mandatory by law for most licensed participants in the financial sector. Our training courses are created by compliance experts and we offer both standard as well as customized training options to meet the specific needs of the organization.

Our AML/CTF training courses are designed to provide comprehensive and practical knowledge to management and staff in various industries. We use real world examples to help participants understand and stay up to date with the latest trends.

Our courses are specifically tailored for businesses in sectors such as virtual asset service providers (VASPs), cryptocurrency exchanges, financial institutions, insurance, real estate and accounting companies.

Upon completing a training course, participants will receive an official certificate that is recognized by relevant regulatory bodies.

Our AML training packages may cover one or more of the following topics:

- Concept and measures related to AML/CTF Compliance

- FATF Recommendations related to Monitoring including Ongoing Monitoring

- Role and responsibilities for CO and MLRO, inc. examples and scenarios of monitoring of transactions

- High Risk Customers, Areas and their Ongoing Monitoring

- Currency Transaction Reports (CTRs), Suspicious Transaction Report (STRs) and other reporting requirements in AML regime etc

AML requirements

Available AMLs

Extra services

- AML specialistAML specialist. Person with experience in financial sector and corresponding education.3 months7,500€6 months12,000€12 months18,000€

- AML trainingOur training courses are created by compliance experts and we offer both standard as well as customized training options to meet the specific needs of the organization. Upon completing a training course, participants will receive an official certificate that is recognized by relevant regulatory bodies.Price:

1,500€

In total

Additional services:

0€

Total:

0€

Ready-made companies

Dont want to wait? Buy the ready-made company.